UK Tax Thresholds

July 22nd, 2022

Frozen tax thresholds pull more Britons into higher rates

As the global recession rumbles on, the UK Government has effectively utilised stealth to increase the group subject to its highest rate of Income Tax, being 45%.

The retention of the frozen tax thresholds has led to a 50% increase in those caught at the higher rate in 2022-2023 compared with 2019-2020.

Tax Threshold

The threshold for the highest rate of UK Income Tax has remained unchanged at £150,000 and Chancellor Rishi Sunak has frozen all UK income tax thresholds for a four-year period, commencing April 2022. Whilst the logic may have made sense at the time, it does not recognise the impact on the economy with the increase in average earnings not remaining sufficiently cushioned to balance out the increase in living costs.

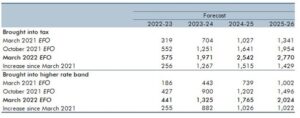

When Sunak introduced the freeze in the April 2021 Budget, the policy was expected to raise £8.1bn a year by 2025-26. However, with higher UK inflation leading to a larger catchment group, the Office for Budget Responsibility the country’s independent fiscal watchdog, estimates the effective tax increase will create a noticeable impact upon both those being reclassified as higher-rate taxpayers and those who will fall into the tax thresholds for the first time. See table below.

Table B: Individuals brought into paying tax and taxpayers brought into the higher rate band by freeze on personal allowance and higher rate thresholds [Office for Budget Responsibility]

Freeze Impact

The effects of the freeze to the top Income Tax threshold are exacerbated by the freezes across other thresholds.

Announced in the same budget was the withdrawal of the Income Tax personal allowance on earnings above £100,000. This tax policy had the consequence of creating a marginal rate of Income Tax at 60% for some higher earners.

Similarly, the £50,000 threshold at which child benefit starts to be withdrawn, through the High Income Child Benefit Charge, remains frozen. This tax charge creates a 65% marginal rate of Income Tax for parents or the partners of parents with three children, with earnings between £50,000 and £60,000 a year.

National Insurance

Official forecasts show that the total tax burden is now set to rise to its highest level since the late 1940s. The Government have defended this taxation policy by highlighting the rise in the threshold for paying National Insurance with a recent tax cut worth £330, on average.

The rise means that most people on an annual salary of up to £12,570 pay no Income Tax and no National Insurance. However, by raising the National Insurance rates by 1.25 percentage points, millions of people will now effectively pay more in taxes, when compared to the previous system.

Tax Impact

The impact of these changes may not be felt by individuals immediately. However, the Government is set to generate significant additional revenue over the next few years in an attempt to address the economic impact of the Coronavirus pandemic. Individuals should therefore be prepared for an inevitable pinch on their disposable income.

If you are concerned about the impact changes in tax legislation will have upon your financial affairs, please feel free to contact Briars.

Learn how to set up a business in the UK with our guides.

Copyright © 2024 Briars Group | All Rights Reserved | Read Our Cookie Policy